Automating enterprise workflows at scale

For years, Brex coasted by with a simplistic accounting journal. Smaller players were close enough to their employees’ spending that a relatively manual entry was sufficient.

However, as Brex entered the game with the bigger players, we hit a wall. Enterprise leads in the sales pipeline were blocked from full product adoption after multiple year-long sales cycles. Every day we punted automation work, (which was every cycle. Let's be honest, automation is accounting's biggest fear), it was a huge threat to lose one our biggest customers back to their old systems.

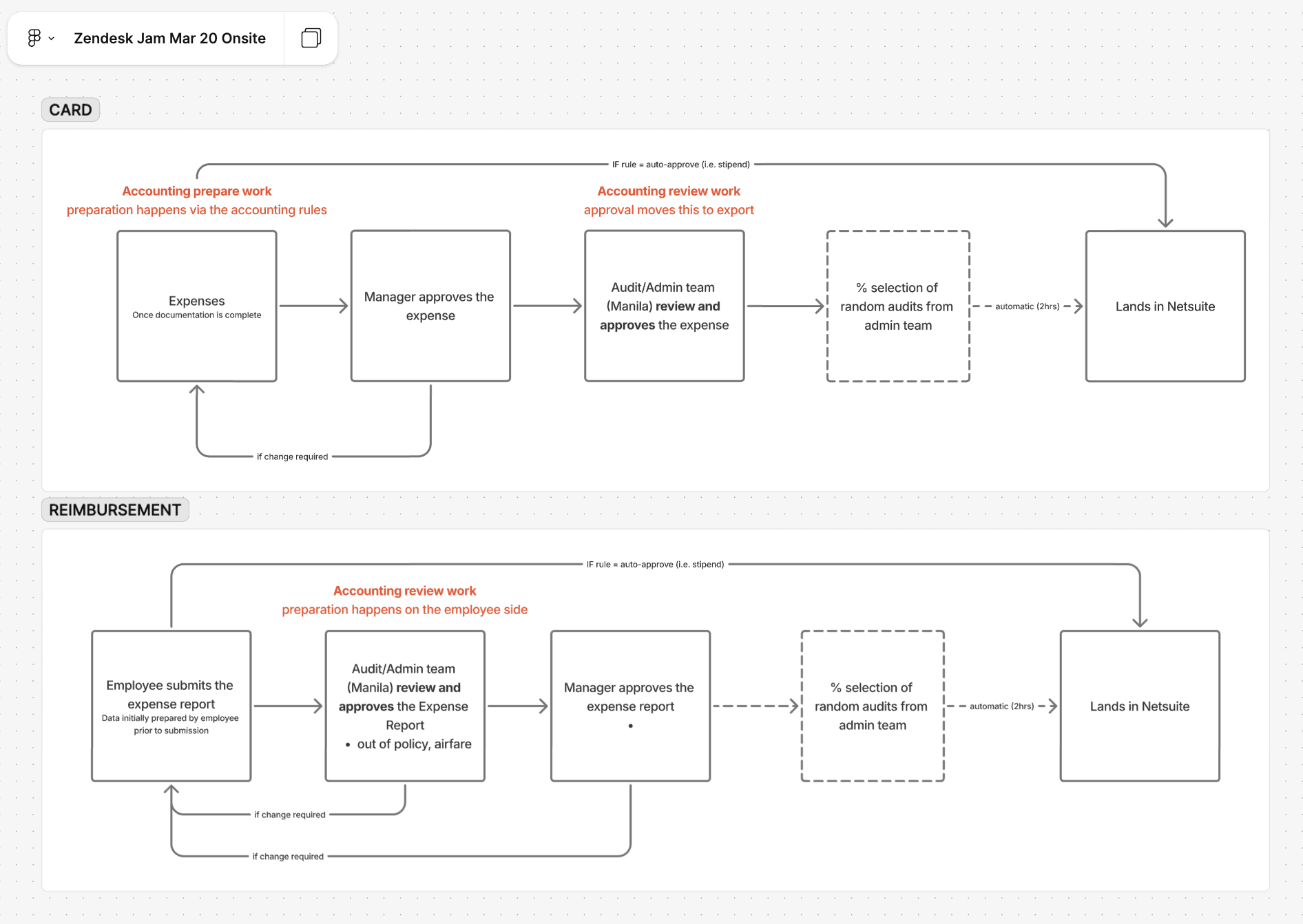

Our Accounting Journal today was a 3-step process:

Map accounting data during onboarding (for example, you’d want all ‘AWS’ merchant spending to push to your ERP’s ‘AWS’ line items).

Transactions appear in our accounting journal to “prepare”, or fill out accounting fields

A second admin must “review” each transaction, before exporting to finalize into the ERP.

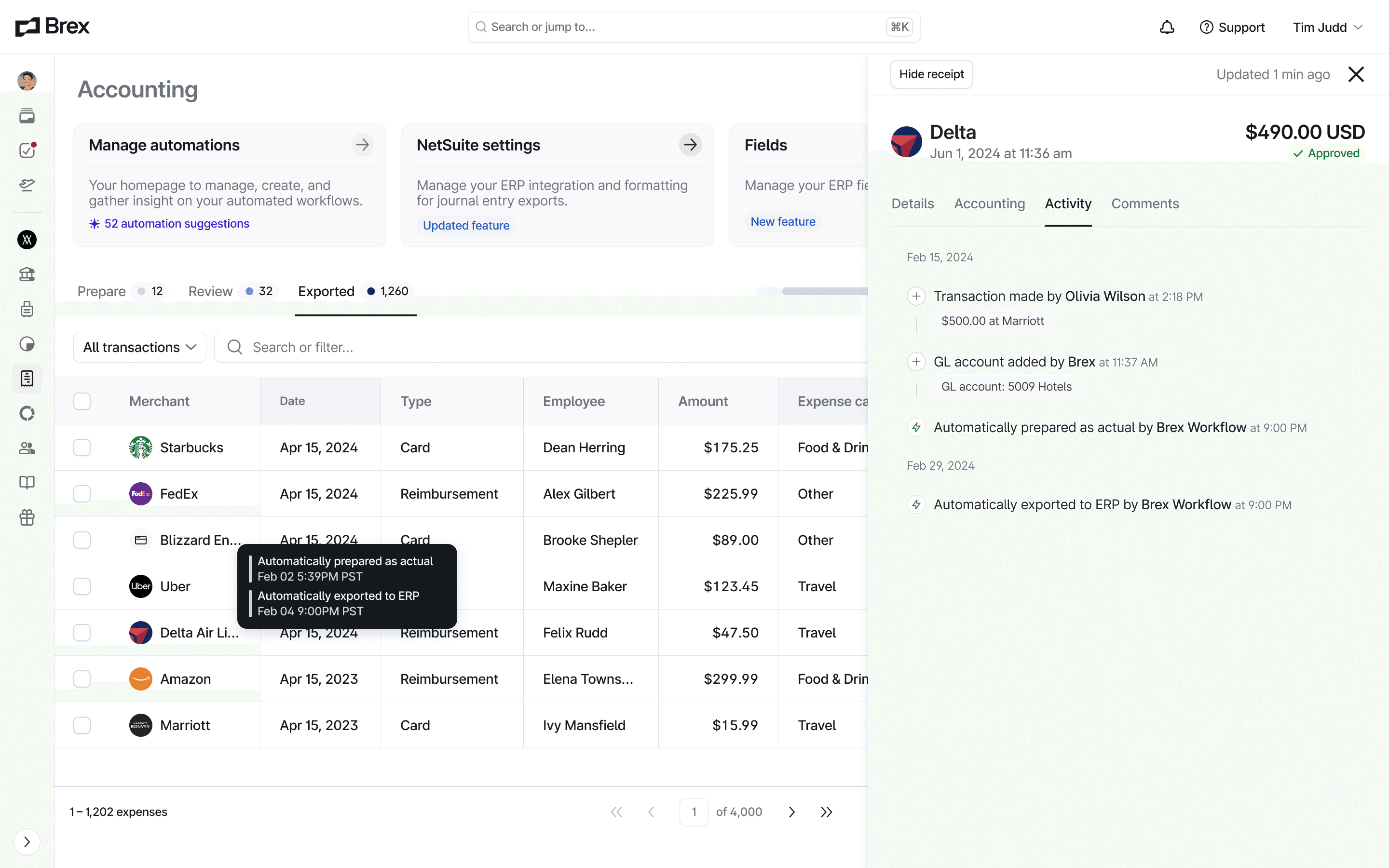

The shocking part? 68% of transactions went untouched from step to step. After the initial mappings were set, users were just shuffling data forward without changing anything. (Foreshadowing — a massive opportunity to automate).

Zendesk, with 7k employees, was stuck at a 10% pilot after an 18-month sales cycle. They had never once been able to complete a month-end close on Brex. All stakes were on the table as me, the VP of product and design, and our Zendesk POCs hashed out a co-design session, as a wedge into making sure we built the right thing for the upcoming release cycle.

We spent six straight hours trying to finalize even a small fraction of our user's transaction, filtering, sorting, spot checking, and holding our breath while clicking the big orange “Export” button. Even I was in the room yelling, “Wait! Stop — can you check this line one more time?”

As the designer, it felt dejecting to watch your product fail time after time.

Luckily, two prior investments set us up to fix this.

Accruals gave confidence to act on incomplete data (reverse next cycle to net to zero).

Custom Fields unlocked specialized conditional logic (e.g. only auto-export if client code contains “LATAM”).

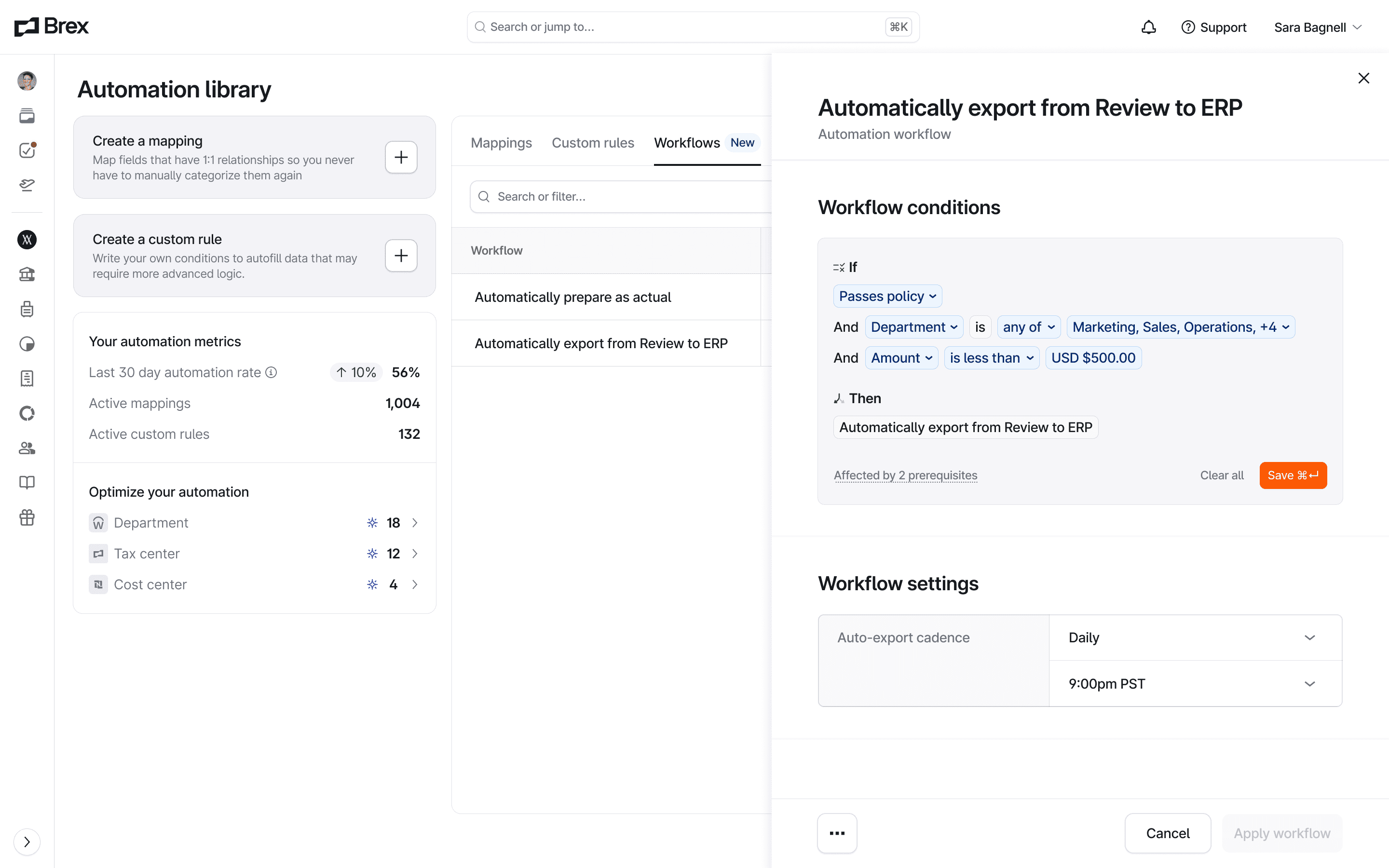

In order to ensure solid user understanding from here on out, we had to align on a critical distinction:

Rules fill in data.

Workflows move the transaction based on that data.

This pattern needed to scale across Brex’s varied product lines:

Banking → will require automatic deposit rules.

Bill Pay → will require automatic approval chains.

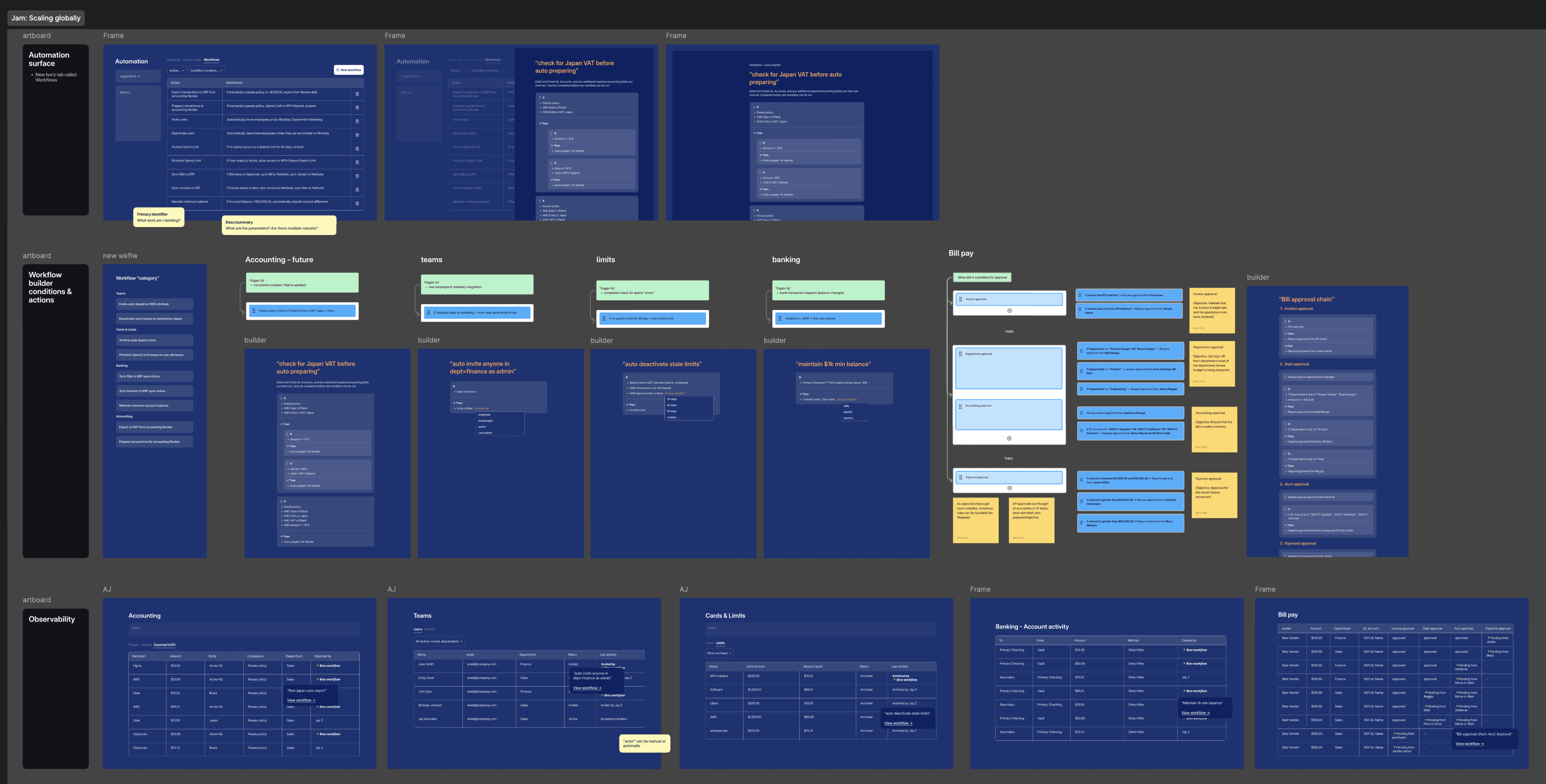

A good, cross-platform design must offer familiarity across all products to enable faster user learning. So, I hosted a jam on “Workflows Platform” with designers on each team across the organization, aligning on a structure that could scale horizontally.

AUDITABILITY & OBSERVABILITY

Users must see exactly what happened, when, and why — and trace it back to the workflow that triggered it.

SHOW > TELL

Preload the most common flows as a default template. Users can update then switch it on anytime.

BEST BITE FIRST

Eng constrain under sales pressure meant ruthless cuts. We had to launch with the set of capabilities that led to most volume.

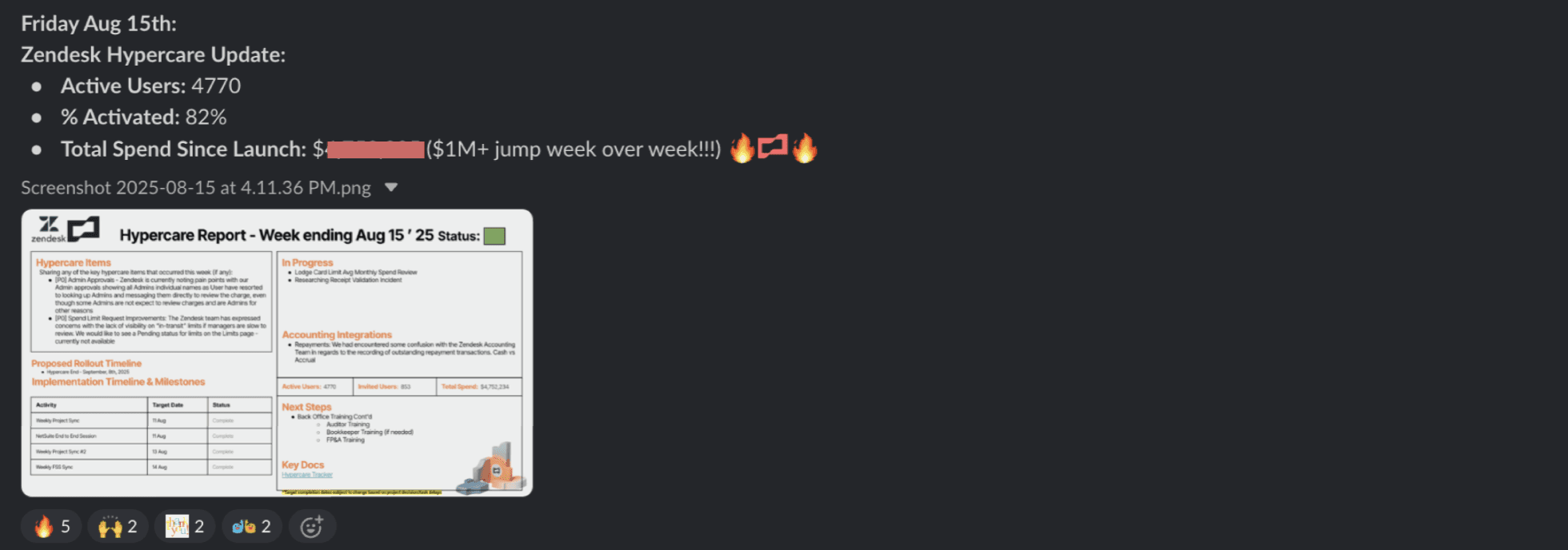

With workflows in place, Zendesk expanded from 700 pilot users to their entire organization. In 2 months, 4k+ employees have begun using Brex cards — a more than 5× increase in adoption and more rolling in.

On top of that, Restoration Hardware, Uber, and Coinbase were all in codesign sessions asking for similar workflows. Because we designed for an adaptable, fields-first experience, it was easy, for example, for Restoration Hardware to swap “autoexport type: direct to ERP” in a simple chip to fit their workflow: “autoexport type: CSV”

For Brex, the workflows engine we piloted in Accounting later became the blueprint for Banking (auto-deposit), Bill Pay (approval chains), and beyond.